|

Wealth Preservation: the endgame for an Early and Richer Retirement.In this phase during your financial lifecycle your income generating assets should form the basis to pay for all your expenses in the form of dividends and interest receipts. In other words, other people are paying you for your current and future expenses and outgoings.

The wealth preservation phaseEarlier, I mentioned that there are three distinct periods in ones financial life cycle, including:

I also mentioned, that in each phase of your financial life cycle there are a number of things you need to do. In fact in the wealth preservation phase, this is more important than ever in order to preserve your wealth, so I will repeat them here again. What happens in the wealth preservation phase?At the end of the accumulation phase of your financial life cycle, you have arrived in the rather fortunate situation that:

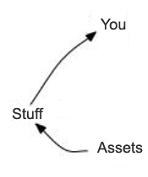

You are at the stage that you have accumulated a sufficient amount of income generating assets throwing off more than enough money to cover all your current and future spending. Your cash flow cycle will look like this:

As you keep adding to your income generating assets, over time, your asset based income start to increase growing fast. Since this income is more than what you need you re-invest and re-invest. Both your assets and your income start to compound exponentially which will further accelerate your income leading towards a richer and richer retirement. At this stage, you may well start considering leaving your employment as a salary is not really required any longer to live comfortably. You will have reached the point that you have truly become financially independent. Congratulations! You have reached the stage of a rich and early retirement.What happens next? Your savings rate may now start to plateau even to turn negative as you start to begin to live off your life savings, such as your pension(s), State Pension and investment income. In this final stage of your financial life cycle your priorities should be completely focused on making your investments last long enough till the end of your life, and, to have a life style in relative comfort. During this final stage of your financial life cycle, your main emphasises lies in:

What do you think? Is this a realistic scenario?Share your thoughts with us whether you think that this is possible or not.

Return from this page to Earn To Save Page

Do you think that early retirement

|

What if you knew when high

quality dividend paying

shares are historically

undervalued or overvalued?

Wouldn't that be invaluable

information allowing you to

make much better informed

investment decisions?

Dividend Income Investor

1. shows you what we buy,

2. when we buy shares and

3. when we sell shares in

our own real-money

Dividend Income Portfolio

CLICK HERE to find out

By continuing to use this site, you agree to the use of cookies.

Click HERE to find out more about cookies and our Cookie Policy.

Follow me at Twitter, click:

Get live commentary on dividend paying companies and updates of our progress at Dividend Income Investor.com

Your assets form the basis to pay for all your expenses in the form of dividends and interest receipts. In other words, other people are paying you for your current and future stuff.

Your assets form the basis to pay for all your expenses in the form of dividends and interest receipts. In other words, other people are paying you for your current and future stuff.