|

Investing for Retirement starts with the Creation of Surplus Funds Once you realise that the majority of wealth is created from investment income rather than savings or employment income, it makes sense to focus on investing for retirement rather than working more.

According to a recent study from insurer Aviva, unless you start to save more and earlier you face a seriously reduced standard of living once you retire! So, how do we start investing for retirement?Generally there are three distinct periods in your "financial life cycle", including:

Within each of these periods in your financial life cycle there are four things you need to try to do towards investing for retirement:

It sounds easy, doesn’t it? It is easy, but it requires patience, self-control and a dedicated long-term wealth building plan. Ok, let me walk you through the first period of your financial lifecycle in some more detail. The earn to spend phaseAt the start of your financial life cycle, in the main, once you have entered the job market, during the first 10, 15 or even 20 years or so of your career your income tends to double or even triple (sometimes much more, if you are lucky). Nevertheless, in most cases, in the early part of your adult working life your savings are likely to be relatively low, or, in the worse case, non-existent.

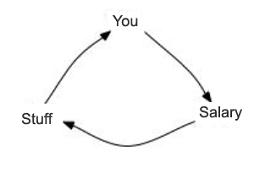

Much, if not all of your income is spent on daily outgoings, establishing a family, renting or buying (and furnishing) your home, putting your children through education, paying for family holidays, etc. However, remember, controlling your expenses and reducing or eliminating debt is the first step towards building wealth and investing for retirement. Unfortunately, many people spend (almost) all of their income and save nothing or very little. Schematically your cash flow looks like this:

However, there is nothing left for you to invest for retirement! Note, that, according to the Department for Work and Pensions, four out five of young people and only half of those aged between 25 and 34 are not saving for their retirement. Make sure you're not one of them.

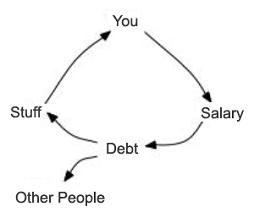

Perhaps getting into debt helps... it never does!Of course, people with a sufficient credit score can go into debt. Today almost anyone can do this.

Debt can be used to pay for extra stuff and depending on the size of your salary this can be used to pay for the interest and repay the debt over time. These days, this is the way most people handle their personal finance. In this case, your financial success depends on being good at handling debt. You will notice that the debt box has a small leak of money that goes to other people, such as the mortgage loan provider, credit card provider, store card operator, etc. It is not uncommon for families to spend 20 or 30 per cent or even much more of their income on debt and mortgage service as well as interest payments. They risk ending up in a debt spiral. In particular if they lose their jobs.

Enter your wealth building periodHowever, over time, as long as you remain in sufficiently high paid employment, you are likely to be able to convert some of your debts, such as your mortgage, into an asset. At that stage, you are increasing the capital base in your house. Without realising it you will have entered the wealth accumulation phase of your financial life cycle.

|

What if you knew when high

quality dividend paying

shares are historically

undervalued or overvalued?

Wouldn't that be invaluable

information allowing you to

make much better informed

investment decisions?

Dividend Income Investor

1. shows you what we buy,

2. when we buy shares and

3. when we sell shares in

our own real-money

Dividend Income Portfolio

CLICK HERE to find out

By continuing to use this site, you agree to the use of cookies.

Click HERE to find out more about cookies and our Cookie Policy.

Follow me at Twitter, click:

Get live commentary on dividend paying companies and updates of our progress at Dividend Income Investor.com

What happens here, is that you use your time into paid work which provides you with a salary that is then used to pay for all your goods and services (‘stuff’) that goes back to you.

What happens here, is that you use your time into paid work which provides you with a salary that is then used to pay for all your goods and services (‘stuff’) that goes back to you.

During this part of your financial life cycle, the amount of your mid- and long-term debt is likely to increase substantially due to mortgages, loans to cars or other debts.

During this part of your financial life cycle, the amount of your mid- and long-term debt is likely to increase substantially due to mortgages, loans to cars or other debts.